Under the 2017 budget to be introduced tonight, the municipal tax rate will decrease by nearly 3.49 percent.

“We’ve taken a fine tooth comb to this budget in order to develop a spending plan that reduces costs without sacrificing core essential services,” said Mayor Gerry Scharfenberger, Ph.D. “We consistently seek ways to further minimize costs, maximize revenues and stretch a dollar.”

The municipal levy will decrease by $161,459 under the proposed budget. For the average homeowner, municipal taxes will decrease $5.31 this year.

Key Budget Facts

- Insurance costs, primarily health insurance, have increased by $320,000 or 3.12 %.

- The snow budget has been decreased by $180,000 thanks to a milder winter.

- Stable fuel prices means a $100,000 reduction in this year’s budget fuel budget.

- The Township realizes savings through a variety of shared service agreements with other municipalities, the Middletown Board of Education, and Monmouth County. A recent addition is a shared service agreement with Fair Haven for services provided by the Chief Financial Officer, the Tax Collector and the Qualified Purchasing Agent.

- The 2017 proposed municipal budget is, once again, well below the state-mandated levy cap and remains in full conformance with the state levy cap law.

- The Township budget makes up only approximately 21% of the average property tax bill, the remaining portion relates to the school and county tax levies.

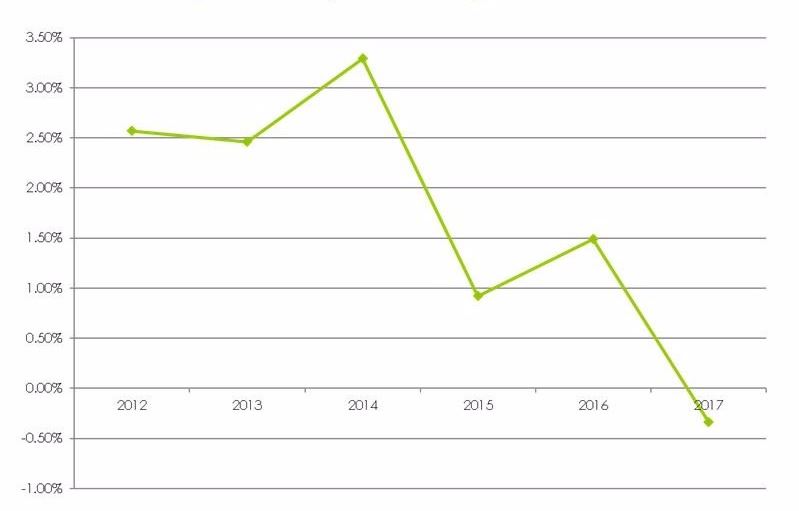

- On average, Middletown Township’s annual tax levy increases have been minimal; amongst the lowest in Monmouth County throughout the last decade. The Township Committee is pleased to report a tax decrease in FY 2017.